How do I pay PAYE and NICs?

PAYE and NICs are due from the employer to HMRC by 22nd of the following month (unless you have a quarterly payment period).

HMRC do offer a Direct Debit option but this currently is for a single payment which means you need to log in and update your payment every month; we advise to continue paying by bank transfer until a full DD service is offered by HMRC.

You can find the correct bank details to send your payment to here

Don't forget to enter the full reference with your payment which includes the final 4 digits indicating the month and tax year that you are making the payment for - this helps to eliminate allocation errors at HMRC.

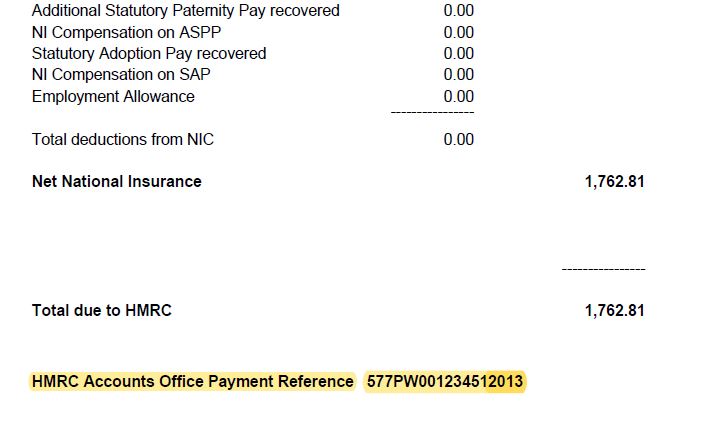

If we run your payroll for you you'll find your reference to use on the Statutory Return, an example of which you can find below, with the reference highlighted in yellow. The final 4 digits represent the year (20 for 2020) and month (13 for Month 13 which is used for post-year end payments such as Class 1aNICs on P11d benefits)