Capital Allowances 130% Superpower! Kapow! Invest now or later?

Earlier this year, you may have seen in the news – or online – talk of a new super duper 130% Capital Allowances deduction intended to accelerate investment by businesses. AKA the Capital Allowances Superpower! But unless you’re already claiming capital allowances tax relief, this might not mean much to you. But it really should. Why? Well, in a nutshell, the government will PAY YOU to invest in new assets for your business now until 31st March 2023.

If you are looking to invest in your business you should read on….

WHAT IS CAPITAL ALLOWANCES TAX RELIEF?

Capital Allowances is a tax relief which enables a limited company to deduct the cost of capital assets from its profits. The result of this means the tax the company pays is reduced, for the year the claim is made.

Usually, Capital Allowances are for purchases of assets up to £1m, of which the company can claim back 100% of the purchase cost. It’s already a generous tax relief but now it’s even better....

HARNESS THE CAPITAL ALLOWANCES SUPERPOWER!

If a limited company invests in a qualifying NEW asset, they can now deduct 130% of the cost from their profits, and the even bigger benefit…there is no £1m limit on the amount which can be claimed. This is a huge opportunity!

The only BUT, purchases must be made between 1st April 2021 and 31st March 2023, and it only applies to certain new assets. However, the list is long!

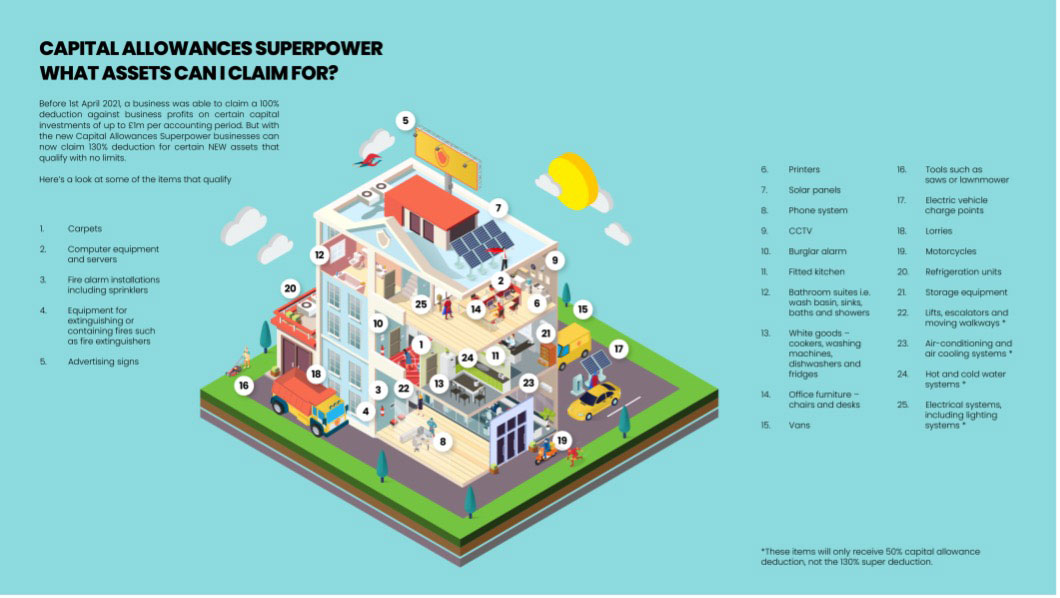

Take a look inside the building below and find out the types of items that qualify for the relief, there is everything from laptops, to furniture, to lighting systems… even toilets!

Please note this isn’t an exhaustive list of qualifying assets.

SHOULD I INVEST NOW OR LATER?

If you are a limited company, thinking about buying new business assets, refurbishing or fitting out a commercial property, and your company has cash available to invest in new items before 31st March 2023, you might want to make that investment sooner rather than later.

Specifically, limited companies with profits less than £250k should consider investing now and bringing forward any planned purchases of capital assets. However, this isn’t a decision to jump into without having a clear strategy in place.

The rules around Capital Allowances are inherently complex, so if you’re planning to invest in capital assets to benefit from this superpower, we recommend seeking advice first.

Please book in a call with us, and we’ll make sure you are doing this in the most tax efficient way.