Employing a sales rep

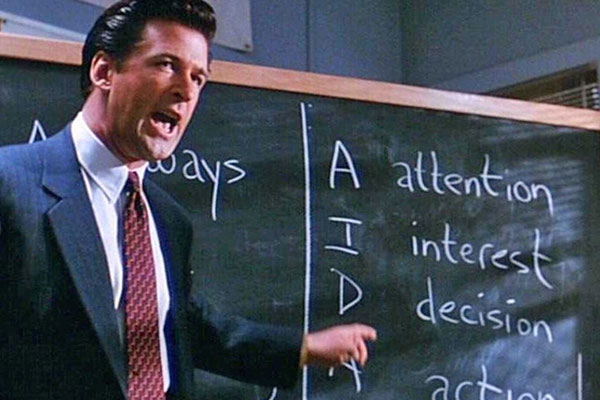

Is coffee really for closers only?

Glengarry Glen Ross, perhaps the ultimate sales film of all time, never really answers that question.But as you sip your coffee or tea reading this article, has taking on a sales rep ever crossed your mind?

If you come from a sales or sales management background, the chances are that you do it yourself or that you have your own rep there already. For you, sales and managing reps is part of who you are – it’ll have been a big chunk of your professional career. So this article isn’t aimed at you and you’ll know the answers to some or all of these questions already.

For customers without any training or experience in sales or managing salespeople, is this a road you should think about going down? And what are the economics you need to look at as part of your decision-making process?

For the purposes of this article, a “sales rep” is someone whose main role is to go to visit potential clients in their homes or workplace with the specific intention of getting a prospect to sign on “the line that is dotted” (Glengarry Glen Ross again).

Employing a sales rep – do I need one?

If you’re happy with your level of profitability, how much you personally pay yourself from your business, and you have no real urge in you to expand your company, then the answer is “no”.

If, on the other hand, you’re desperate to grow your company, build a team, delegate your responsibilities and build turnover and profit, the answer is “yes”.

If you’ve just said “yes” and you’re at the limit of your own personal capacity to quote, meet prospects, sell, fulfil orders, and look after customers, it’s a “double yes”.

Employing a sales rep – how much should I pay them in basic wages?

Sales reps generally expect remuneration in two ways – a basic wage and then a commission payment based upon their volume of sales.

The basic wage for sales reps varies around the country. A good guide would be to use the online calculator at Monster - click here.Type “sales rep” into the form, enter your location, and press “Submit”. You’ll see three figures – a low figure, a high figure, and a median figure.

In Didcot, Oxfordshire, where Panthera is based, the median figure for a sales rep is £22,260. If you do advertise for staff, try to go for the median level as this will attract the attention of sales people with experience.

That’s important because if you’ve never been a rep or a sales manager yourself, you’ll need someone good at presentation and closing to devise the way of selling what you do to potential clients face to face.

Employing a sales rep – what should their target be and how much commission should I pay them?

Now you’ve got their attention with the basic salary, it’s now time to think about commission.

The best rule of thumb when thinking about paying commission is how much do you want to make off your sales rep’s labour? Every time you pay commission out, that’s money going from your company bank account into the pockets of your rep and a grateful HMRC.

Most sales organisations want to make around £4.50 in gross profit (after the cost of goods or supply) for every £1 they spend on the rep.

How would you work this out? Let’s say that you pay the median Didcot wage as basic - £22,260. Add on the cost of National Insurance Employer’s Contributions and that takes you to £24,786. Then let’s say that to make £4.50 in gross profit, you need to sell £10.00 worth of goods or services.

Multiply the basic wage plus NICs by the turnover needed to create £4.50 in gross profit – in this case, that means your rep has a target of £247,860 worth of sales a year. From their labour, before commissions payable, your company will make £111,537 (that’s £247,860 multiplied by 0.45) minus the wages and NI costs (£24,786), leaving you with £86,751.

Your sales rep thereofre has a minimum target of £247,860 per annum, or £20,655 a month.

Once they’ve paid their way and made you profit, it’s time to start sharing the spoils. If you offer 10% commission on all sales above £20,655 a month and that propels your rep to sell £30,000 a month, you’ll have made an additional £9,345 in revenue producing £4,205 more in gross profit.

Once you’ve given your rep his or her bonus on the additional sales, that means that you pay out £934.50 in commissions and you’ve made an extra £3,270 in profit that month (calculations do not take into account National Insurance Employer’s Contributions on the commission payment).

Employing a sales rep – where do their leads come from?

This is where you start cutting into the potential gains a sales rep could bring. While it is not unusual for many sales reps to be tasked with their own lead generation, it takes time. A rep doing his or her own lead generation might only create 5 or 6 opportunities a week.

You could employ a telesales rep to make appointments for them. If you don’t want to add to your fixed costs, outsourced telesales companies exist who make appointments for you but they can cost up to £30 per hour.

Other routes to market include email marketing, internet advertising, and exhibitions and fairs. They are lots of alternative ways to approach this and it’s probably better to work with your sales rep to find the best way.

Employing a sales rep – should they have a company car?

Company cars have been falling out of favour with employers for many years. There is an arguable advantage that may be worth exploiting on very low emission vehicles.

A company car is also now taxable when it’s provided to an employee (even for those earning less than £8,500 a year although there are exceptions to this rule). The car will also incur a Class 1A liability to your company and there’ll be more charges you’ll face on top of that if your company provides the fuel for the vehicle.

Employing a sales rep – is it worth it?

A great sales rep, enthusiastic, motivated, and passionate, will bring in revenue to your business. They’re brilliant for morale and laughs. They’re not only great for prospecting new customers but they can really accelerate the speed and volume of orders coming in from existing customers through skilled account management.

It will take 3-4 months before you start seeing any real return from a rep, especially if they have to generate their own leads and devise their own method of face-to-face selling. If you paid the Didcot average rep wage, it would be advisable to make sure that your company has spare cash in it to cover up to 5-6 months of losses on the rep’s labour before you see the gain.

Whatever you decide, good luck. And make sure there’s plenty of coffee