Jeremy Hunt's Autumn statement - 2022

The Chancellor of the Exchequer, Jeremy Hunt, delivered his much-anticipated Autumn Statement on 17 November.

The Autumn Statement focused on ‘stability, growth and public services.’ And, on the whole, big businesses and the City have cautiously welcome the key announcements.

Here’s our summary of the main points of interest for SMEs:

Main tax measures from the Autumn Statement

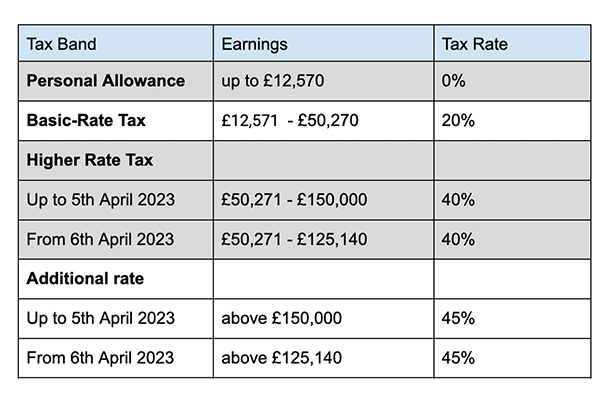

- Income Tax Thresholds - From April 2023 the additional rate (45%) band applies from income over £125,140 (previously £150,000). All other tax rates and brackets remain unchanged. These bands will be fixed until April 2028. Freezing the bands in this way is a so-called ‘stealth tax’, because an increasing proportion of people’s income is taxed over time, and potentially in higher tax bands, due to wage inflation.

The table below shows the tax bands.

- National Insurance Thresholds - The current Lower Earnings Limit (£6,396) and Small Profits Threshold (£6,725) will be unchanged for 2023/24. The Secondary Threshold, the level at which employers start to pay national insurance) will be fixed at the current £9,100 per annum until April 2028. The Upper Secondary Threshold (where the rate paid by employees drops) will be fixed at the current £50,270 until April 2028.

- Capital Gains Tax Thresholds - Currently the first £12,300 is free of CGT. That will drop to £6,000 from April 2023 and £3,000 from April 2024

- Dividends Tax Thresholds - Currently the first £2,000 is free of tax. That will drop to £1,000 from April 2023 and £500 from April 2024

- National insurance - The Class 2 rate (flat rate for self-employed people) will increase from £3.15 to £3.45 per week from April 2023. The Class 3 (voluntary contributions) rate will increase at the same time to £17.45 from £15.85. These increases are in line with inflation.

- Research and Development - From April 2023, the uplift of R&D expenditure in the small and medium enterprises scheme will be reduced from 130% to 86%, and the payable credit rate will fall from 14.5% to 10%.

- Business Rates - There is a range of measures to support business with business rates. Businesses in the retail, hospitality and leisure sector will be entitled to relief of 75% of their rates bills. Measures will also be taken to limit the cost of increases arising from the 2023 revaluation and to ease the impact of Small Business Rates Relief and Rural Rates Relief where those reliefs are lost because of the valuation.

Other Measures

- Benefits - Benefits will increase by 10.1% from April 2023. This is in line with inflation. There were some suggestions that the increase should be around 5%, in line with average earnings growth.

- Energy cost savings - The cap on unit rates for domestic consumers will increase from April 2023 so that average user will be charged £3,000 (currently £2,500/annum) until March 2024. The scheme for non-domestic users expires from April 2023 and a review is being undertaken into further support thereafter, which will exclude public sector consumers and is expected to be at a ‘significantly lower scale’ for business users.

- National Living Wage - The rate for individuals aged 23 and over will increase by 9.7% to £10.42/hour from £9.50, with similar-scale increases for other categories of worker.

- Council tax - The maximum that councils can increase council tax by without a local referendum is now 5%, up from 3%.

- ATED - The annual tax on enclosed dwellings charges (a levy on certain residential property held in structures such as companies) will increase by 10.1% from April 2023 in line with inflation.

If you’d like to talk to us about any concerns or worries related to the main announcements, please do get in touch with your account manager. You can read more on the Autumn Statement here.

We’ll be happy to explain more of the details and help you start planning a 2023 strategy to overcome your biggest business challenges.