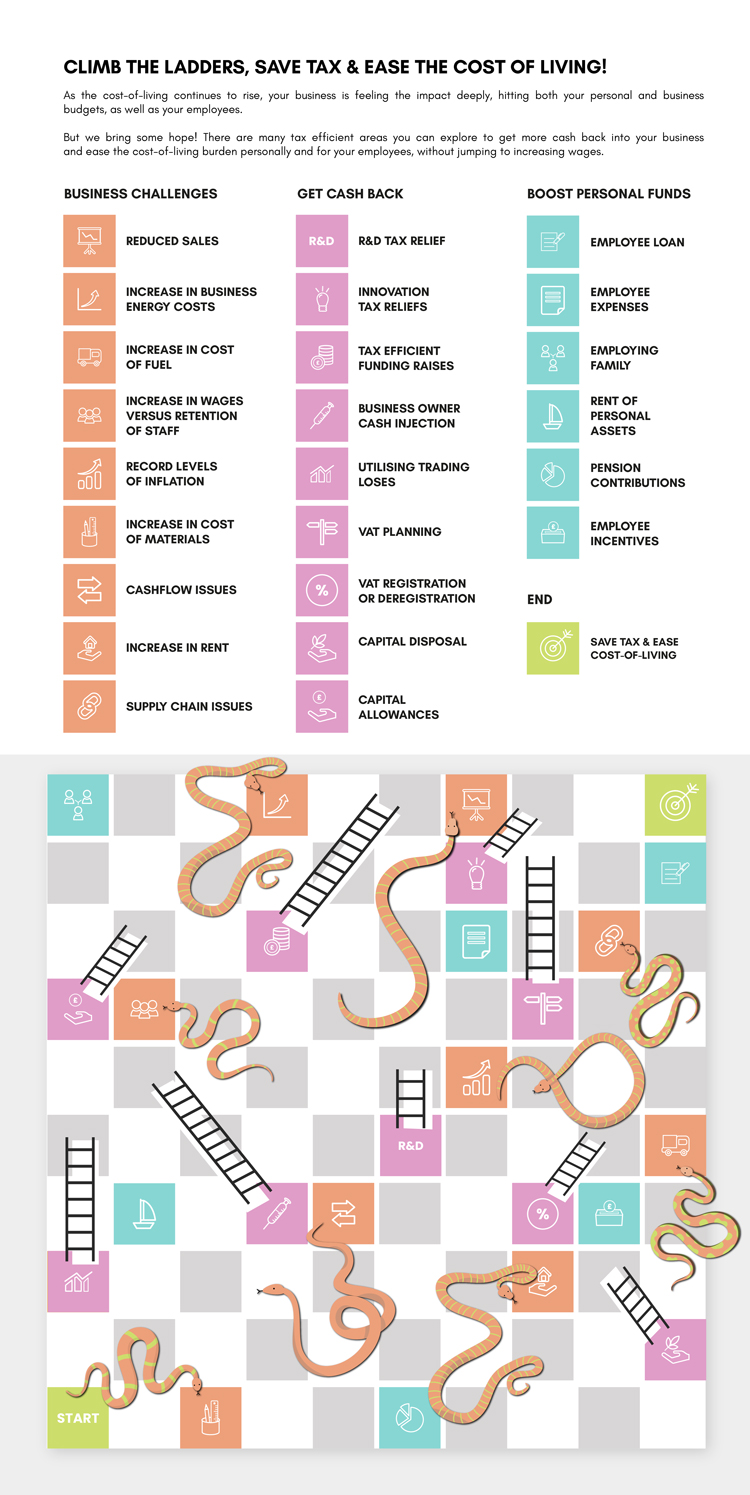

Tackling the cost-of-living crisis with Tax Advice & Reliefs

As the cost-of-living continues to rise, small businesses are feeling the impact deeply, hitting both their personal and business budgets, as well as their employees.

With soaring energy prices, rising inflation, good shortages and supply chain issues businesses have been hit hard. And all this is coupled with the very real concern that trade could drop off if people are forced to cut back their spending.

So, what can businesses do?

Tax advice and tax reliefs is an area often overlooked when businesses are experiencing financial hardship. But tax is a very real cost to businesses and any opportunities to save it should be explored. Not to mention the many ways businesses can look to support employees’ tax efficiently without resorting to increasing wages.

There are many tax efficient ways business owners can look to get more cash back into their business and ease the cost-of-living burden personally and for their employees.

| Innovation tax reliefs | Claim back up to £33 (up to £21.50 after April 2023) for every £100 spent via R&D Tax Relief / claim back up to £90 for every £100 spent via Creative Tax Relief / save 10% in corporation tax on patent box relief claim |

| Funding | Up to £50k back on SEIS funding for investors / up to £300k back on EIS funding for investors / receive up to £1k in interest on business owner loan without paying income tax. |

| VAT | VAT registration – save 20% in VAT on purchases or VAT deregistration – save your customers 20% on VAT on their purchases. |

| Investments | Receive an extra 30% for investments that are eligible under the capital allowances super deduction until 31st March 2023. |

| Losses | Limited companies that have made trading losses can carry them back over the last three years and get a refund for 19% (or up to 25% for profits over £250k from April 2023) corporation tax already paid. |

| Pensions | Pension contributions are tax-deductible so result in a 19% (or up to 25% for profits over £250k from April 2023) corporation tax saving. Pay up to £40k per year into pension saving c.£16.8k for a 40% taxpayer. |

| Employee incentives & expenses | There are numerous tax efficient benefits and business expenses personally paid for to explore to help boost personal funds from trivial benefits to points reward cards. |

| Employee loan | If a business has available cashflow, it can be a good way to incentivise the business owner and employees by offering up to £10k loans, interest free. |

If you are a business owner, valuable tax savings could help with the steep increase in costs your business is experiencing right now, along with many tax reliefs and incentives that could ease the cost-of-living burden for you and your employees.

Don’t ignore the opportunity

Take a good look at the visual to see if anything feels relevant to you. If there is even the smallest chance something might be relevant, get in touch and let’s talk through how we could help.