Our Cashflow Management Service

It’s difficult to understand. You’re running a very profitable business, and yet, you’re struggling to pay the bills. Why is that?

Ultimately, Cash is King and if you don’t have it, life will become difficult.

Cashflow planning is best practice in any business and critical to survival and growth.

Setting targets and monitoring your actual cashflow against your forecast allows you to predict large cash outflows and respond to changes in your business.

It’s about looking forward in the business and preparing you for any bumps in the road coming through.

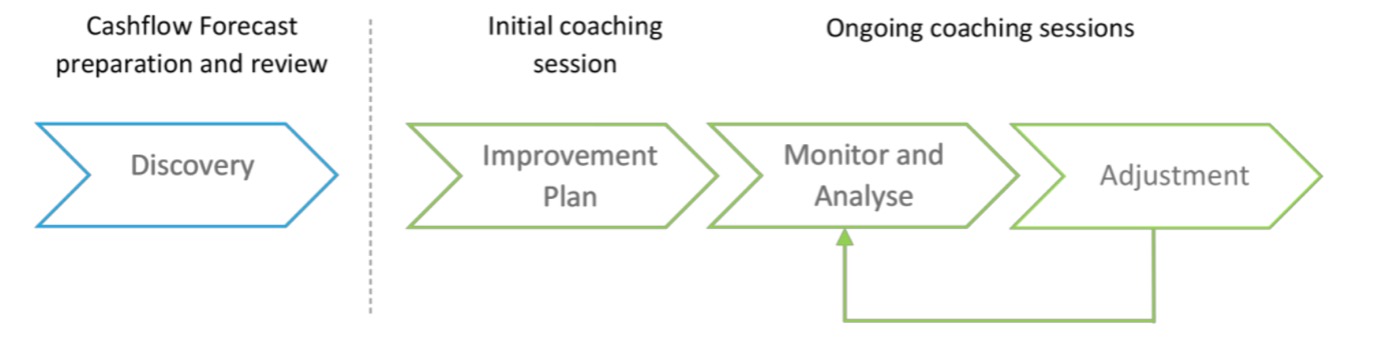

It starts with a Cashflow Forecast.

Critical to understanding how your business will grow over the year, but also a powerful way to build an effective relationship with your financiers; bankers are much more likely to support clients who communicate profit and cashflow plans regularly

Once this is in place, we can create a Cashflow Improvement Plan. Helping you to treat the underlying causes of poor cashflow.

Together we’ll conduct a thorough review of the potential causes of your cashflow challenges. We will set annual goals and devise a 90 day action plan for improvement and hold you accountable to implementing simple strategies to maximise cashflow.

And ultimately help you look ahead with confidence and watch your business thrive.

Summary:

- Monitor actual cashflow against forecast

- Understand key cashflow drivers and your business’s Cash Conversion Cycle

- Identify ways to avoid late payment penalties and interest

- Improve your relationships with financiers and suppliers

- Improve business processes to boost cashflow, profit and business value

- Drive your business to achieving your goals in a managed way

Time to allow:

- 1hr for Cashflow and Profit Improvement session

- 3hrs planning sessions (usually split into 2 meetings)

- Ongoing accountability sessions (if applicable)

Contact us today - the sooner we complete a Cashflow Forecast for you, the sooner we can work together to agree strategies for improvement.